Financial ratios are powerful tools used to analyze a company’s performance and financial health. They provide insights into profitability, liquidity, solvency, and efficiency by comparing different financial statement items. Understanding these formulas is crucial for investors, creditors, and management alike.

Liquidity Ratios

Liquidity ratios measure a company’s ability to meet its short-term obligations. Two key ratios are:

- Current Ratio: This ratio assesses if current assets are sufficient to cover current liabilities. The formula is: Current Assets / Current Liabilities. A ratio above 1 generally indicates good liquidity, but excessively high values might suggest inefficient asset utilization.

- Quick Ratio (Acid-Test Ratio): A more stringent measure of liquidity, excluding inventory, which might not be easily converted to cash. The formula is: (Current Assets – Inventory) / Current Liabilities. A quick ratio closer to 1 is often considered healthy.

Profitability Ratios

Profitability ratios evaluate a company’s ability to generate earnings relative to its revenue, assets, or equity. Key ratios include:

- Gross Profit Margin: This ratio shows the percentage of revenue remaining after deducting the cost of goods sold (COGS). The formula is: (Revenue – COGS) / Revenue. A higher gross profit margin signifies greater efficiency in production and cost management.

- Net Profit Margin: This ratio indicates the percentage of revenue that translates into net income. The formula is: Net Income / Revenue. It reflects the overall profitability after all expenses are considered.

- Return on Assets (ROA): This ratio measures how effectively a company uses its assets to generate profit. The formula is: Net Income / Total Assets. A higher ROA indicates better asset utilization.

- Return on Equity (ROE): This ratio measures the return generated for shareholders’ investment. The formula is: Net Income / Shareholder’s Equity. A higher ROE suggests that the company is effectively using shareholder’s equity to generate profits.

Solvency Ratios

Solvency ratios assess a company’s ability to meet its long-term obligations. A common ratio is:

- Debt-to-Equity Ratio: This ratio compares a company’s total debt to its shareholder’s equity. The formula is: Total Debt / Shareholder’s Equity. A high ratio can indicate excessive reliance on debt financing, potentially increasing financial risk.

Efficiency Ratios

Efficiency ratios measure how efficiently a company utilizes its assets and manages its liabilities. Key ratios include:

- Inventory Turnover Ratio: This ratio indicates how many times a company sells and replaces its inventory during a period. The formula is: Cost of Goods Sold / Average Inventory. A higher turnover ratio generally implies efficient inventory management.

- Accounts Receivable Turnover Ratio: This ratio measures how quickly a company collects its receivables. The formula is: Net Credit Sales / Average Accounts Receivable. A higher turnover ratio suggests efficient credit and collection policies.

It’s important to remember that financial ratios are most meaningful when compared to industry averages, historical data for the same company, and the ratios of competitor companies. Analyzing these ratios in isolation can be misleading. Furthermore, be aware of potential accounting manipulations that could skew these figures. A comprehensive analysis considering both quantitative and qualitative factors provides the best understanding of a company’s financial health.

1000×667 financial financial pahang skills development centre from www.pahangskills.gov.my

1000×667 financial financial pahang skills development centre from www.pahangskills.gov.my

1400×1050 limportanza strategica del rendiconto finanziario yourcfo from www.yourcfo.it

1400×1050 limportanza strategica del rendiconto finanziario yourcfo from www.yourcfo.it

3920×1960 growth strategy business graph analysis concept finance chart data from www.vecteezy.com

3920×1960 growth strategy business graph analysis concept finance chart data from www.vecteezy.com

1920×1200 financial management concept investment flat design payment from www.vecteezy.com

1920×1200 financial management concept investment flat design payment from www.vecteezy.com

1920×1280 guide venture capital financing roseryan from roseryan.com

1920×1280 guide venture capital financing roseryan from roseryan.com

3640×2410 finance system icons symbols finance illustrations creative from creativemarket.com

3640×2410 finance system icons symbols finance illustrations creative from creativemarket.com

4404×2906 personal finance corporate finance main difference from virtualggc.com

4404×2906 personal finance corporate finance main difference from virtualggc.com

1600×1690 finance function business refers functions intended from www.dreamstime.com

1600×1690 finance function business refers functions intended from www.dreamstime.com

1920×1081 economy finance background financial business statistics from www.vecteezy.com

1920×1081 economy finance background financial business statistics from www.vecteezy.com

1200×630 artificial intelligence impacting finance from www.chaserhq.com

1200×630 artificial intelligence impacting finance from www.chaserhq.com

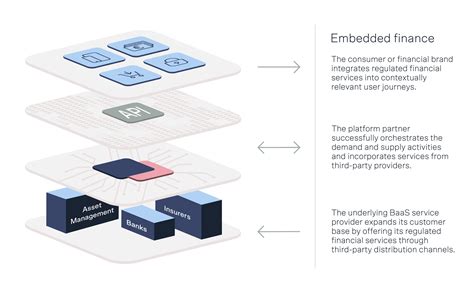

1920×1080 embedded finance examples brimco from www.brimco.io

1920×1080 embedded finance examples brimco from www.brimco.io

1920×1080 manage personal finance beginners guide from blog.shoonya.com

1920×1080 manage personal finance beginners guide from blog.shoonya.com

1200×1003 microsoft power platform smrtr maak je werk sneller slimmer en leuker from smrtr.nl

1200×1003 microsoft power platform smrtr maak je werk sneller slimmer en leuker from smrtr.nl

2560×1969 top ai tools accounting marktechpost from www.marktechpost.com

2560×1969 top ai tools accounting marktechpost from www.marktechpost.com

1200×628 business finance definition benefits types razorpay capital from razorpay.com

1200×628 business finance definition benefits types razorpay capital from razorpay.com

2000×1250 finance wallpapers wallpaperdog from wallpaper.dog

2000×1250 finance wallpapers wallpaperdog from wallpaper.dog

4000×3000 lhistoire de la finance histoire evolutions from www.wmag-finance.fr

4000×3000 lhistoire de la finance histoire evolutions from www.wmag-finance.fr

1920×1440 cases chatgpt finance fusemachines insights from insights.fusemachines.com

1920×1440 cases chatgpt finance fusemachines insights from insights.fusemachines.com

961×574 embedded finance examples benefits opportunities from happay.com

961×574 embedded finance examples benefits opportunities from happay.com

1024×975 finance animation explained keystone media from keystonemediahq.com

1024×975 finance animation explained keystone media from keystonemediahq.com

1000×750 finance outsourcing comprehensive guide pros cons from www.hirewithnear.com

1000×750 finance outsourcing comprehensive guide pros cons from www.hirewithnear.com

1920×1920 icone financeiro png from pt.vecteezy.com

1920×1920 icone financeiro png from pt.vecteezy.com

720×720 accounting finance from www.linkedin.com

720×720 accounting finance from www.linkedin.com

3888×2592 personal finance from www.love-and-i.com

3888×2592 personal finance from www.love-and-i.com

1600×840 personal finance software paid from shawnmanaher.com

1600×840 personal finance software paid from shawnmanaher.com

1200×673 blurry glow background images hd pictures wallpaper from pngtree.com

1200×673 blurry glow background images hd pictures wallpaper from pngtree.com

1600×1051 defi decentralized finance blockchain decentralized financial system from www.dreamstime.com

1600×1051 defi decentralized finance blockchain decentralized financial system from www.dreamstime.com

1633×980 kawaii finance sticker business finance elements doodle finance from www.vecteezy.com

1633×980 kawaii finance sticker business finance elements doodle finance from www.vecteezy.com

1200×628 finance bill kenya highlights from ronalds.co.ke

1200×628 finance bill kenya highlights from ronalds.co.ke

1920×1152 grow money clipart vector design illustration yellow golden coin from www.vecteezy.com

1920×1152 grow money clipart vector design illustration yellow golden coin from www.vecteezy.com

2560×1382 behavioral finance understanding biases tips overcoming from insights.masterworks.com

2560×1382 behavioral finance understanding biases tips overcoming from insights.masterworks.com

1920×1920 set money finance icon logo vector illustration finance pack symbol from www.vecteezy.com

1920×1920 set money finance icon logo vector illustration finance pack symbol from www.vecteezy.com

2400×1256 quick glance sources finance start from razorpay.com

2400×1256 quick glance sources finance start from razorpay.com

1200×768 finance commission india functions article qualifications from www.studyiq.com

1200×768 finance commission india functions article qualifications from www.studyiq.com

2240×1260 guide structuring finance team cfo hub from cfohub.com

2240×1260 guide structuring finance team cfo hub from cfohub.com

1500×1000 bangkok post unlocking power sustainable finance from www.bangkokpost.com

1500×1000 bangkok post unlocking power sustainable finance from www.bangkokpost.com

1766×986 finance definition studyslopecom from studyslope.com

1766×986 finance definition studyslopecom from studyslope.com

1024×576 ways manage personal finances from hbr.org

1024×576 ways manage personal finances from hbr.org

1184×860 financial economics methods models faqs from www.vedantu.com

1184×860 financial economics methods models faqs from www.vedantu.com

1200×627 revolutionizing finance ai automating financial services from aihorrorstories.blogspot.com

1200×627 revolutionizing finance ai automating financial services from aihorrorstories.blogspot.com

1920×1920 icono de gestion de finanzas negocios de dibujos animados vectoriales from es.vecteezy.com

1920×1920 icono de gestion de finanzas negocios de dibujos animados vectoriales from es.vecteezy.com

1720×918 top finance job titles ongig blog from blog.ongig.com

1720×918 top finance job titles ongig blog from blog.ongig.com

2160×1215 finance career from ar.inspiredpencil.com

2160×1215 finance career from ar.inspiredpencil.com

1024×576 structured finance work leia aqui from fabalabse.com

1024×576 structured finance work leia aqui from fabalabse.com

1600×1600 financial logos from animalia-life.club

1600×1600 financial logos from animalia-life.club

960×540 public finance powerpoint template from www.collidu.com

960×540 public finance powerpoint template from www.collidu.com

960×540 decentralized finance defi powerpoint template from www.collidu.com

960×540 decentralized finance defi powerpoint template from www.collidu.com

4800×6592 applications generative ai financial services cb insights from www.cbinsights.com

4800×6592 applications generative ai financial services cb insights from www.cbinsights.com

1920×1120 vector cartoon business finance management icon comic style from www.vecteezy.com

1920×1120 vector cartoon business finance management icon comic style from www.vecteezy.com

1000×563 finance software personal business from happay.com

1000×563 finance software personal business from happay.com

2251×2251 supply chain finance work importance from www.dripcapital.com

2251×2251 supply chain finance work importance from www.dripcapital.com

2560×1645 healthcare finance management comprehensive guide from avonriverventures.com

2560×1645 healthcare finance management comprehensive guide from avonriverventures.com

1000×833 modern financial logo design idea stock vector adobe stock from stock.adobe.com

1000×833 modern financial logo design idea stock vector adobe stock from stock.adobe.com

1600×900 from www.pwc.tw

1600×900 from www.pwc.tw

1201×1501 corporate financeth edition global edition softarchive from softarchive.is

1201×1501 corporate financeth edition global edition softarchive from softarchive.is

3700×2220 money management firms board embedded finance heres from www.solarisgroup.com

3700×2220 money management firms board embedded finance heres from www.solarisgroup.com