Finance restrictive covenants are contractual clauses in loan agreements and bond indentures designed to protect lenders by limiting the borrower’s actions. They provide early warning signals of potential financial distress and give lenders recourse if the borrower violates these restrictions. Covenants help lenders manage risk, as they can intervene before the borrower becomes insolvent.

These covenants fall broadly into two categories: affirmative and negative. Affirmative covenants (also known as positive covenants) require the borrower to do certain things. These are fairly standard and ensure the borrower maintains a sound operational and financial footing. Examples include:

- Maintaining adequate insurance coverage.

- Paying taxes and other obligations promptly.

- Complying with all applicable laws and regulations.

- Maintaining a certain level of tangible net worth.

- Providing timely financial reports to the lender.

Failure to comply with affirmative covenants, while potentially problematic, often indicates a broader issue and can trigger closer scrutiny from the lender.

Negative covenants (also known as restrictive covenants) restrict the borrower from taking certain actions. These are more impactful and often subject to intense negotiation. Common examples include:

- Restrictions on debt: Limiting the amount of new debt the borrower can take on. This prevents the borrower from becoming over-leveraged and ensures sufficient cash flow to service existing debt. Different types of restrictions exist, such as limits on total debt, secured debt, or debt incurred for specific purposes.

- Restrictions on liens: Prohibiting the borrower from granting security interests (liens) on its assets to other creditors. This preserves the lender’s priority in the event of default.

- Restrictions on asset sales: Limiting the borrower’s ability to sell off assets, which could weaken its financial position. Specific thresholds often exist, allowing for minor sales within normal business operations.

- Restrictions on dividends and distributions: Limiting the borrower’s ability to pay dividends or make other distributions to shareholders. This ensures that cash is retained within the business for debt repayment and operations.

- Restrictions on investments: Limiting the borrower’s ability to make investments in other companies or projects. This prevents the borrower from taking on excessive risk or diverting funds from its core business.

- Restrictions on mergers and acquisitions: Limiting or prohibiting the borrower from engaging in mergers or acquisitions, especially those that could negatively impact its creditworthiness.

Violation of a covenant, known as a covenant breach, triggers an event of default. The lender then has the right to take action, such as accelerating the repayment of the loan, seizing collateral, or demanding immediate repayment. However, lenders often work with borrowers to resolve covenant breaches, especially if they are minor or temporary. This may involve waiving the breach, amending the covenant, or granting a forbearance period. The decision depends on the severity of the breach, the lender’s confidence in the borrower’s management team, and the overall economic environment.

Restrictive covenants are essential tools for lenders to manage risk and protect their investments. They provide a framework for monitoring the borrower’s financial health and taking corrective action if necessary. While covenants can be burdensome for borrowers, they are a necessary part of the lending process and can ultimately help borrowers maintain financial discipline.

1400×1050 limportanza strategica del rendiconto finanziario yourcfo from www.yourcfo.it

1400×1050 limportanza strategica del rendiconto finanziario yourcfo from www.yourcfo.it

1741×980 economy finance concept financial business investment statistics from www.vecteezy.com

1741×980 economy finance concept financial business investment statistics from www.vecteezy.com

3920×1960 growth strategy business graph analysis concept finance chart data from www.vecteezy.com

3920×1960 growth strategy business graph analysis concept finance chart data from www.vecteezy.com

1920×1280 guide venture capital financing roseryan from roseryan.com

1920×1280 guide venture capital financing roseryan from roseryan.com

1920×1200 financial management concept investment flat design payment from www.vecteezy.com

1920×1200 financial management concept investment flat design payment from www.vecteezy.com

4404×2906 personal finance corporate finance main difference from virtualggc.com

4404×2906 personal finance corporate finance main difference from virtualggc.com

1920×1081 economy finance background financial business statistics from www.vecteezy.com

1920×1081 economy finance background financial business statistics from www.vecteezy.com

1200×630 artificial intelligence impacting finance from www.chaserhq.com

1200×630 artificial intelligence impacting finance from www.chaserhq.com

1600×1690 finance function business refers functions intended from www.dreamstime.com

1600×1690 finance function business refers functions intended from www.dreamstime.com

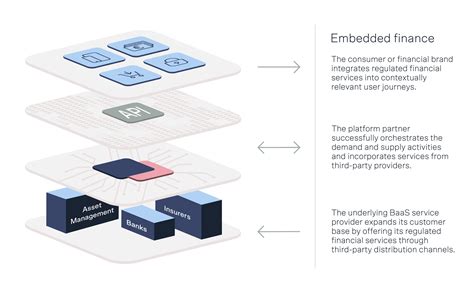

1920×1080 embedded finance examples brimco from www.brimco.io

1920×1080 embedded finance examples brimco from www.brimco.io

3640×2410 finance system icons symbols finance illustrations creative from creativemarket.com

3640×2410 finance system icons symbols finance illustrations creative from creativemarket.com

1200×628 swine definition finance tracy macias blog from storage.googleapis.com

1200×628 swine definition finance tracy macias blog from storage.googleapis.com

3888×2592 personal finance from www.love-and-i.com

3888×2592 personal finance from www.love-and-i.com

1170×400 business finance continuing studies uvic from continuingstudies.uvic.ca

1170×400 business finance continuing studies uvic from continuingstudies.uvic.ca

1920×1080 manage personal finance beginners guide from blog.shoonya.com

1920×1080 manage personal finance beginners guide from blog.shoonya.com

961×574 embedded finance examples benefits opportunities from happay.com

961×574 embedded finance examples benefits opportunities from happay.com

1920×1120 vector cartoon business finance management icon comic style from www.vecteezy.com

1920×1120 vector cartoon business finance management icon comic style from www.vecteezy.com

2000×1250 finance wallpapers wallpaperdog from wallpaper.dog

2000×1250 finance wallpapers wallpaperdog from wallpaper.dog

1600×840 personal finance software paid from shawnmanaher.com

1600×840 personal finance software paid from shawnmanaher.com

2560×1969 top ai tools accounting marktechpost from www.marktechpost.com

2560×1969 top ai tools accounting marktechpost from www.marktechpost.com

4000×3000 lhistoire de la finance histoire evolutions from www.wmag-finance.fr

4000×3000 lhistoire de la finance histoire evolutions from www.wmag-finance.fr

1200×768 finance commission india functions article qualifications from www.studyiq.com

1200×768 finance commission india functions article qualifications from www.studyiq.com

1024×975 finance animation explained keystone media from keystonemediahq.com

1024×975 finance animation explained keystone media from keystonemediahq.com

1200×673 rendering glowing digital business interface showcasing finance from pngtree.com

1200×673 rendering glowing digital business interface showcasing finance from pngtree.com

1200×628 finance bill kenya highlights from ronalds.co.ke

1200×628 finance bill kenya highlights from ronalds.co.ke

1000×750 finance outsourcing comprehensive guide pros cons from www.hirewithnear.com

1000×750 finance outsourcing comprehensive guide pros cons from www.hirewithnear.com

1920×1920 icone financeiro png from pt.vecteezy.com

1920×1920 icone financeiro png from pt.vecteezy.com

720×720 accounting finance from www.linkedin.com

720×720 accounting finance from www.linkedin.com

2560×1382 behavioral finance understanding biases tips overcoming from insights.masterworks.com

2560×1382 behavioral finance understanding biases tips overcoming from insights.masterworks.com

4800×6592 applications generative ai financial services cb insights from www.cbinsights.com

4800×6592 applications generative ai financial services cb insights from www.cbinsights.com

2400×1256 quick glance sources finance start from razorpay.com

2400×1256 quick glance sources finance start from razorpay.com

1024×576 ways manage personal finances from hbr.org

1024×576 ways manage personal finances from hbr.org

1766×986 finance definition studyslopecom from studyslope.com

1766×986 finance definition studyslopecom from studyslope.com

2240×1260 guide structuring finance team cfo hub from cfohub.com

2240×1260 guide structuring finance team cfo hub from cfohub.com

1600×1051 defi decentralized finance blockchain decentralized financial system from www.dreamstime.com

1600×1051 defi decentralized finance blockchain decentralized financial system from www.dreamstime.com

1920×1920 set money finance icon logo vector illustration finance pack symbol from www.vecteezy.com

1920×1920 set money finance icon logo vector illustration finance pack symbol from www.vecteezy.com

1500×1000 bangkok post unlocking power sustainable finance from www.bangkokpost.com

1500×1000 bangkok post unlocking power sustainable finance from www.bangkokpost.com

1920×1440 cases chatgpt finance fusemachines insights from insights.fusemachines.com

1920×1440 cases chatgpt finance fusemachines insights from insights.fusemachines.com

2160×1215 finance career from ar.inspiredpencil.com

2160×1215 finance career from ar.inspiredpencil.com

1920×1152 finance images clip art from ar.inspiredpencil.com

1920×1152 finance images clip art from ar.inspiredpencil.com

1720×918 top finance job titles ongig blog from blog.ongig.com

1720×918 top finance job titles ongig blog from blog.ongig.com

1184×860 financial economics methods models faqs from www.vedantu.com

1184×860 financial economics methods models faqs from www.vedantu.com

960×540 decentralized finance defi powerpoint template from www.collidu.com

960×540 decentralized finance defi powerpoint template from www.collidu.com

1600×1600 financial logos from animalia-life.club

1600×1600 financial logos from animalia-life.club

1024×576 structured finance work leia aqui from fabalabse.com

1024×576 structured finance work leia aqui from fabalabse.com

960×540 public finance powerpoint template from www.collidu.com

960×540 public finance powerpoint template from www.collidu.com

1000×563 finance software personal business from happay.com

1000×563 finance software personal business from happay.com

2251×2251 supply chain finance work importance from www.dripcapital.com

2251×2251 supply chain finance work importance from www.dripcapital.com

2000×2000 premium vector hand draw business finance doodle set vector from www.freepik.com

2000×2000 premium vector hand draw business finance doodle set vector from www.freepik.com

2560×1645 healthcare finance management comprehensive guide from avonriverventures.com

2560×1645 healthcare finance management comprehensive guide from avonriverventures.com

1000×833 modern financial logo design idea stock vector adobe stock from stock.adobe.com

1000×833 modern financial logo design idea stock vector adobe stock from stock.adobe.com

1600×900 from www.pwc.tw

1600×900 from www.pwc.tw

1201×1501 corporate financeth edition global edition softarchive from softarchive.is

1201×1501 corporate financeth edition global edition softarchive from softarchive.is

3700×2220 money management firms board embedded finance heres from www.solarisgroup.com

3700×2220 money management firms board embedded finance heres from www.solarisgroup.com

1920×1080 personal finance important shoonya blog from blog.shoonya.com

1920×1080 personal finance important shoonya blog from blog.shoonya.com

2048×2048 essentials corporate finance edition stephen ross randolph from www.prioritytextbook.com

2048×2048 essentials corporate finance edition stephen ross randolph from www.prioritytextbook.com