Here’s some helpful information in HTML format about common finance quiz topics, useful for understanding the answers:

Finance Quiz Prep: Common Concepts & Explanations

Time Value of Money (TVM)

This is a cornerstone. The core idea is that money today is worth more than the same amount of money in the future, due to its potential earning capacity. Consider these elements:

- Present Value (PV): The current worth of a future sum of money or stream of cash flows, given a specified rate of return.

- Future Value (FV): The value of an asset or investment at a specific date in the future, based on an assumed rate of growth.

- Interest Rate (r): The rate of return used to discount future values back to their present values. Higher rates mean lower present values (for the same future value).

- Number of Periods (n): The length of time the money is invested or the number of payments in an annuity.

Expect questions about calculating PV, FV, or even solving for ‘r’ or ‘n’ given the other variables. For example:

What’s the present value of $1,000 to be received in 5 years, assuming a discount rate of 5%?

The formula is PV = FV / (1 + r)^n. So, PV = $1,000 / (1 + 0.05)^5, which equals approximately $783.53.

Financial Ratios

Ratios are used to analyze a company’s financial performance. They are derived from information found on the income statement, balance sheet, and statement of cash flows. Common categories include:

- Liquidity Ratios: Measure a company’s ability to meet its short-term obligations (e.g., Current Ratio, Quick Ratio). A higher current ratio generally indicates a stronger ability to pay short-term debts.

- Profitability Ratios: Measure a company’s ability to generate profits (e.g., Gross Profit Margin, Net Profit Margin, Return on Equity (ROE), Return on Assets (ROA)). Higher margins and returns are generally favorable.

- Solvency Ratios: Measure a company’s ability to meet its long-term obligations (e.g., Debt-to-Equity Ratio, Times Interest Earned). Lower debt-to-equity ratios are generally considered safer.

- Efficiency Ratios: Measure how efficiently a company is using its assets (e.g., Inventory Turnover, Accounts Receivable Turnover). Higher turnover rates often indicate better efficiency.

Example: A company has a Current Ratio of 0.8. What does this indicate?

This indicates that the company’s current assets are less than its current liabilities. It *may* suggest difficulty meeting short-term obligations, although more context is needed.

Capital Budgeting

This involves evaluating potential investment projects. Key metrics include:

- Net Present Value (NPV): The present value of expected cash inflows minus the present value of expected cash outflows. A positive NPV suggests the project will increase shareholder wealth.

- Internal Rate of Return (IRR): The discount rate that makes the NPV of a project equal to zero. If the IRR is greater than the cost of capital, the project is typically accepted.

- Payback Period: The length of time required for an investment to generate enough cash flow to cover its initial cost. It’s a simple measure, but doesn’t consider the time value of money or cash flows beyond the payback period.

Example: A project has an NPV of -$1,000. Should the company accept the project?

No, a negative NPV indicates the project is expected to *decrease* shareholder wealth and should generally be rejected.

Risk and Return

A fundamental principle is that higher potential returns are generally associated with higher risk. Concepts to know:

- Standard Deviation: A measure of the dispersion of a set of data points around their mean. In finance, it’s often used to measure the volatility of an investment’s returns. Higher standard deviation means higher risk.

- Beta: A measure of a security’s volatility relative to the market. A beta of 1 indicates the security’s price will move with the market. A beta greater than 1 suggests the security is more volatile than the market.

These principles are frequently tested in quizzes. Good luck!

1400×1050 limportanza strategica del rendiconto finanziario yourcfo from www.yourcfo.it

1400×1050 limportanza strategica del rendiconto finanziario yourcfo from www.yourcfo.it

1741×980 economy finance concept financial business investment statistics from www.vecteezy.com

1741×980 economy finance concept financial business investment statistics from www.vecteezy.com

3920×1960 growth strategy business graph analysis concept finance chart data from www.vecteezy.com

3920×1960 growth strategy business graph analysis concept finance chart data from www.vecteezy.com

1920×1280 guide venture capital financing roseryan from roseryan.com

1920×1280 guide venture capital financing roseryan from roseryan.com

1920×1200 financial management concept investment flat design payment from www.vecteezy.com

1920×1200 financial management concept investment flat design payment from www.vecteezy.com

4404×2906 personal finance corporate finance main difference from virtualggc.com

4404×2906 personal finance corporate finance main difference from virtualggc.com

1920×1081 economy finance background financial business statistics from www.vecteezy.com

1920×1081 economy finance background financial business statistics from www.vecteezy.com

1200×630 artificial intelligence impacting finance from www.chaserhq.com

1200×630 artificial intelligence impacting finance from www.chaserhq.com

1600×1690 finance function business refers functions intended from www.dreamstime.com

1600×1690 finance function business refers functions intended from www.dreamstime.com

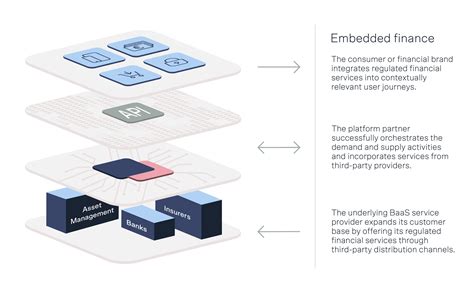

1920×1080 embedded finance examples brimco from www.brimco.io

1920×1080 embedded finance examples brimco from www.brimco.io

3640×2410 finance system icons symbols finance illustrations creative from creativemarket.com

3640×2410 finance system icons symbols finance illustrations creative from creativemarket.com

1200×628 swine definition finance tracy macias blog from storage.googleapis.com

1200×628 swine definition finance tracy macias blog from storage.googleapis.com

3888×2592 personal finance from www.love-and-i.com

3888×2592 personal finance from www.love-and-i.com

1170×400 business finance continuing studies uvic from continuingstudies.uvic.ca

1170×400 business finance continuing studies uvic from continuingstudies.uvic.ca

1920×1080 manage personal finance beginners guide from blog.shoonya.com

1920×1080 manage personal finance beginners guide from blog.shoonya.com

961×574 embedded finance examples benefits opportunities from happay.com

961×574 embedded finance examples benefits opportunities from happay.com

1920×1120 vector cartoon business finance management icon comic style from www.vecteezy.com

1920×1120 vector cartoon business finance management icon comic style from www.vecteezy.com

2000×1250 finance wallpapers wallpaperdog from wallpaper.dog

2000×1250 finance wallpapers wallpaperdog from wallpaper.dog

1600×840 personal finance software paid from shawnmanaher.com

1600×840 personal finance software paid from shawnmanaher.com

2560×1969 top ai tools accounting marktechpost from www.marktechpost.com

2560×1969 top ai tools accounting marktechpost from www.marktechpost.com

4000×3000 lhistoire de la finance histoire evolutions from www.wmag-finance.fr

4000×3000 lhistoire de la finance histoire evolutions from www.wmag-finance.fr

1200×768 finance commission india functions article qualifications from www.studyiq.com

1200×768 finance commission india functions article qualifications from www.studyiq.com

1024×975 finance animation explained keystone media from keystonemediahq.com

1024×975 finance animation explained keystone media from keystonemediahq.com

1200×673 rendering glowing digital business interface showcasing finance from pngtree.com

1200×673 rendering glowing digital business interface showcasing finance from pngtree.com

1200×628 finance bill kenya highlights from ronalds.co.ke

1200×628 finance bill kenya highlights from ronalds.co.ke

1000×750 finance outsourcing comprehensive guide pros cons from www.hirewithnear.com

1000×750 finance outsourcing comprehensive guide pros cons from www.hirewithnear.com

1920×1920 icone financeiro png from pt.vecteezy.com

1920×1920 icone financeiro png from pt.vecteezy.com

720×720 accounting finance from www.linkedin.com

720×720 accounting finance from www.linkedin.com

2560×1382 behavioral finance understanding biases tips overcoming from insights.masterworks.com

2560×1382 behavioral finance understanding biases tips overcoming from insights.masterworks.com

4800×6592 applications generative ai financial services cb insights from www.cbinsights.com

4800×6592 applications generative ai financial services cb insights from www.cbinsights.com

2400×1256 quick glance sources finance start from razorpay.com

2400×1256 quick glance sources finance start from razorpay.com

1024×576 ways manage personal finances from hbr.org

1024×576 ways manage personal finances from hbr.org

1766×986 finance definition studyslopecom from studyslope.com

1766×986 finance definition studyslopecom from studyslope.com

2240×1260 guide structuring finance team cfo hub from cfohub.com

2240×1260 guide structuring finance team cfo hub from cfohub.com

1600×1051 defi decentralized finance blockchain decentralized financial system from www.dreamstime.com

1600×1051 defi decentralized finance blockchain decentralized financial system from www.dreamstime.com

1920×1920 set money finance icon logo vector illustration finance pack symbol from www.vecteezy.com

1920×1920 set money finance icon logo vector illustration finance pack symbol from www.vecteezy.com

1500×1000 bangkok post unlocking power sustainable finance from www.bangkokpost.com

1500×1000 bangkok post unlocking power sustainable finance from www.bangkokpost.com

1920×1440 cases chatgpt finance fusemachines insights from insights.fusemachines.com

1920×1440 cases chatgpt finance fusemachines insights from insights.fusemachines.com

2160×1215 finance career from ar.inspiredpencil.com

2160×1215 finance career from ar.inspiredpencil.com

1920×1152 finance images clip art from ar.inspiredpencil.com

1920×1152 finance images clip art from ar.inspiredpencil.com

1720×918 top finance job titles ongig blog from blog.ongig.com

1720×918 top finance job titles ongig blog from blog.ongig.com

1184×860 financial economics methods models faqs from www.vedantu.com

1184×860 financial economics methods models faqs from www.vedantu.com

960×540 decentralized finance defi powerpoint template from www.collidu.com

960×540 decentralized finance defi powerpoint template from www.collidu.com

1600×1600 financial logos from animalia-life.club

1600×1600 financial logos from animalia-life.club

1024×576 structured finance work leia aqui from fabalabse.com

1024×576 structured finance work leia aqui from fabalabse.com

960×540 public finance powerpoint template from www.collidu.com

960×540 public finance powerpoint template from www.collidu.com

1000×563 finance software personal business from happay.com

1000×563 finance software personal business from happay.com

2251×2251 supply chain finance work importance from www.dripcapital.com

2251×2251 supply chain finance work importance from www.dripcapital.com

2000×2000 premium vector hand draw business finance doodle set vector from www.freepik.com

2000×2000 premium vector hand draw business finance doodle set vector from www.freepik.com

2560×1645 healthcare finance management comprehensive guide from avonriverventures.com

2560×1645 healthcare finance management comprehensive guide from avonriverventures.com

1000×833 modern financial logo design idea stock vector adobe stock from stock.adobe.com

1000×833 modern financial logo design idea stock vector adobe stock from stock.adobe.com

1600×900 from www.pwc.tw

1600×900 from www.pwc.tw

1201×1501 corporate financeth edition global edition softarchive from softarchive.is

1201×1501 corporate financeth edition global edition softarchive from softarchive.is

3700×2220 money management firms board embedded finance heres from www.solarisgroup.com

3700×2220 money management firms board embedded finance heres from www.solarisgroup.com

1920×1080 personal finance important shoonya blog from blog.shoonya.com

1920×1080 personal finance important shoonya blog from blog.shoonya.com

2048×2048 essentials corporate finance edition stephen ross randolph from www.prioritytextbook.com

2048×2048 essentials corporate finance edition stephen ross randolph from www.prioritytextbook.com